Why a Successful Storm Damage Roof Insurance Claim Matters More Than Ever

A storm damage roof insurance claim is often necessary after severe weather, but success requires understanding seven critical steps and acting quickly with a qualified local roofer. Homeowners who follow a structured claims process with expert support from a professional roofing contractor in Northern Virginia consistently secure higher-quality repairs and more accurate settlements. With roof repair costs reaching $31 billion nationwide in 2024a 30% jump since 2022a well-managed claim can save you thousands in out-of-pocket expenses and protect your homes long-term value.

The process can feel overwhelming, as wind and hail alone accounted for over half of all residential roofing claims in 2024. Many homeowners struggle with policy terms or face undervalued damage assessments.

Subtle storm damage, especially from smaller hailstones, can be hard to spot but may cause significant long-term problems. That’s why having a trusted local partner for durable roofing solutions is essential for a proper assessment and securing the settlement you deserve.

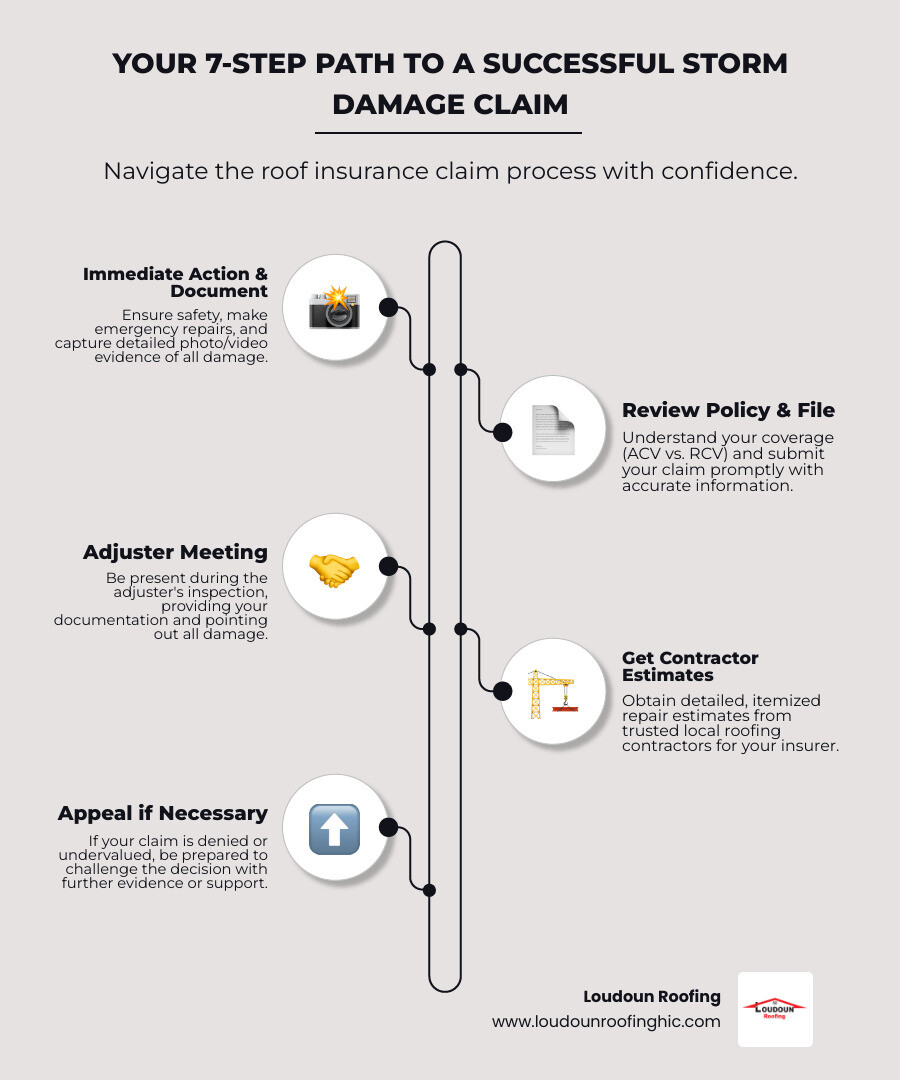

Quick Answer: Essential Steps for a Storm Damage Roof Insurance Claim

- Take immediate safety measures and prevent further damage

- Document everything with photos, videos, and detailed notes

- Review your policy to understand coverage (ACV vs. RCV)

- File promptly with your insurance company

- Meet with the adjuster and provide thorough documentation

- Get estimates from reputable local contractors

- Appeal if necessary when claims are denied or undervalued

Step 1 & 2: Immediate Post-Storm Actions and Flawless Documentation

After a storm in Northern Virginia, your first priority is safety. Once it’s safe, you must take steps to protect your property and prepare for a storm damage roof insurance claim. Perform emergency roof repair for visible damage like holes or major leaks by tarping exposed areas to prevent further water intrusion. Your policy likely requires you to mitigate damage, so keep all receipts for temporary fixes for reimbursement. Do not perform permanent repairs before the adjuster’s inspection.

The second critical step is to document everything carefully to create a strong evidence trail for your claim.

How to Effectively Document Roof Damage

Thorough documentation is your strongest tool for a successful storm damage roof insurance claim. It provides clear evidence, prevents disputes, and ensures all damage is accounted for.

- Photos and Videos: Take comprehensive photos and videos with your smartphone. Capture close-ups of specific damage (dents, lifted shingles, granule loss) and wide-angle shots of the entire roof. Also, document any interior damage like water stains.

- Date and Time Stamps: Ensure your photos are time-stamped to create a clear timeline relative to the storm.

- Written Notes: Keep a detailed log with the storm’s date, weather conditions (wind, hail size), a description of all observed damage, and a record of emergency repairs and their costs.

- Hail Impact Examples: On asphalt shingles, hail damage appears as dark spots where granules are missing or as small indentations. On wood roofs, it can cause splits with sharp edges.

- Wind Damage Examples: Look for missing, curled, or lifted shingles. Also check for damage to flashing, vents, and gutters.

- Interior Leak Evidence: Document all signs of water intrusion inside, such as drips or warped drywall, to link roof damage to interior property issues.

For a complete evaluation, especially for subtle damage, a professional storm damage assessment by a qualified local roofer is invaluable. An expert report can significantly strengthen your storm damage roof insurance claim.

Step 3 & 4: Decoding Your Policy and Filing the Claim

With documentation ready, the next step is to understand your insurance policy and file your storm damage roof insurance claim. Review your policy for coverage types, covered perils (like wind and hail), exclusions (like wear and tear or floods), and filing deadlines. Most insurers require claims to be filed within one year.

Contact your insurer promptly to initiate the claim. Be prepared to provide:

- Your policy number

- The date of the storm (date of loss)

- A clear description of the damage

- Your contact information

- All photos, videos, and notes

- Receipts for any emergency repairs

Understanding Your Policy for a Storm Damage Roof Insurance Claim

Your homeowners insurance policy protects your home’s structure, including the roof, under its dwelling coverage. Most policies cover damage from specific events, or “perils.”

Common covered perils for roof damage include:

- Windstorms and hail

- Snow, sleet, or ice

- Lightning and fire

- Falling objects like trees

Equally important are the exclusions. Insurance typically does not cover:

- Normal wear and tear

- Damage from neglect or poor maintenance

- Flooding (requires a separate policy)

- Earthquakes or pests

Understanding these distinctions is crucial. For a deeper dive, review a comprehensive guide to homeowners insurance claims.

ACV vs. RCV: The Most Important Detail in Your Policy

The most critical detail in your policy is whether it provides Actual Cash Value (ACV) or Replacement Cost Value (RCV) coverage. This directly impacts your payout for a storm damage roof insurance claim.

- Actual Cash Value (ACV): Pays the depreciated value of your roof. It’s the replacement cost minus depreciation for age and wear. An ACV policy on an older roof will likely leave you with significant out-of-pocket expenses for a new one.

- Replacement Cost Value (RCV): Covers the full cost to replace your damaged roof with a new one of similar quality, without deducting for depreciation. The payout is often split: an initial ACV payment, followed by the remaining amount (recoverable depreciation) after repairs are complete.

Here’s a simple comparison:

| Feature | Actual Cash Value (ACV) | Replacement Cost Value (RCV) |

|---|---|---|

| Payout Basis | Depreciated value of the roof | Cost to replace with new, similar quality |

| Depreciation | Subtracted from payout | Initially withheld, then paid upon completion of repairs (recoverable depreciation) |

| Out-of-Pocket | Often significant, covering the difference between ACV and new roof cost | Generally only the deductible, once recoverable depreciation is paid |

| Roof Age Impact | Heavily influenced; older roofs receive less | Less influenced; aims to restore to pre-loss condition with new materials |

Understanding this difference is paramount. You can learn more about how roof insurance claims explained work by visiting our detailed guide.

Your Step-by-Step Guide to the Storm Damage Roof Insurance Claim Process

After filing your claim, you will work with an insurance adjuster, who is the only person who can approve it. Their job is to assess the damage, confirm it’s covered, and estimate repair costs. Be prepared for their visit with all your documentation. It is highly recommended to have a reputable local roofing contractor present during this inspection.

After the adjuster’s visit, you’ll need detailed contractor estimates. Beware of “storm chasers”—out-of-state companies that may perform shoddy work and disappear. Always choose a reputable local roofer with a proven track record in Leesburg and Loudoun County.

Interacting with the Insurance Adjuster

The adjuster’s purpose is to verify the damage and estimate repair costs from the insurance company’s perspective. To ensure a fair assessment:

- Be Present: Attend the inspection to point out all documented damage, including on the roof and inside your home.

- Provide Evidence: Give the adjuster your organized photos, notes, and emergency repair receipts.

- Answer Questions Honestly: Provide clear, factual answers about the storm and the damage.

- Understand the ‘Scope of Loss’: Carefully review the adjuster’s report, which details their findings and cost estimates, to ensure it’s accurate.

- Have Your Roofer Present: A trusted contractor can discuss technical details with the adjuster, point out subtle damage, and ensure local building codes are considered, leading to a more accurate assessment.

Clear communication and thorough preparation are key. If you need a partner in this process, find a reputable local roofer in your area who understands the local claims process.

Choosing a Reputable Roofing Contractor in Leesburg, VA

Choosing the right contractor is critical for your storm damage roof insurance claim. A good contractor provides quality repairs and helps steer the insurance process.

Here’s what to look for in a Northern Virginia roofer:

- Licensed and Insured: Verify the contractor is licensed in Virginia and carries full liability and workers’ compensation insurance.

- Local Presence: Prioritize contractors with a physical office and a long-standing reputation in your community. They understand local codes and are available to honor warranties.

- Storm Damage Experience: Choose a contractor who specializes in storm damage and insurance claims.

- Checking References: Ask for references and check online reviews to gauge their reputation.

- Detailed Estimates: Insist on a written, itemized estimate that includes all costs for materials, labor, and permits.

- Avoiding Scams: Be wary of low bids, high-pressure tactics, or demands for full payment upfront.

Working with a GAF Certified Contractor ensures you receive professional service that meets high standards. For more advice, see our tips for finding the best roofing company in Leesburg, VA.

Step 5, 6, & 7: Navigating Claim Challenges, Denials, and Disputes

Even with good preparation, you may face challenges with your storm damage roof insurance claim, such as low settlement offers or denials. An initial offer may be low because the adjuster’s estimate omits necessary items like code upgrades or full labor costs. In this case, your contractor can help you “supplement” the claim with additional documentation. If your claim is denied or significantly undervalued, you have the right to dispute the decision.

Common Reasons for a Storm Damage Roof Insurance Claim Denial

Understanding why a claim might be denied helps you proactively address potential issues. Common reasons for denial include:

- Improper Installation: The insurer may argue that pre-existing poor workmanship contributed to the failure.

- Inadequate Attic Ventilation: Poor ventilation can cause premature aging, which the insurer might blame for the damage.

- Pre-existing Damage: If the adjuster finds old damage, they may deny the claim by stating the storm wasn’t the sole cause.

- Waiting Too Long to File: Delaying your claim can make it difficult to prove the storm caused the damage, leading to denial.

- Policy Exclusions: The damage may be from an excluded cause, such as wear and tear or neglect.

- Lack of Evidence: Insufficient documentation of the damage can result in a denial.

If you’re dealing with a roof leak, our guide to roof leak repair can provide valuable insights.

What to Do If Your Claim is Denied or Undervalued

A denied or undervalued storm damage roof insurance claim is not the final word. You have several options to pursue a fair outcome:

- Request a Second Adjuster Inspection: Ask the insurance company for a second opinion from a different adjuster.

- Hire a Public Adjuster: A public adjuster works for you, not the insurer, to negotiate your claim. They are paid a percentage of the settlement.

- Obtain a Structural Engineer Report: For complex damage, an independent engineer’s report provides powerful, unbiased evidence.

- Formal Dispute Letter: Write a formal letter to your insurer outlining why their decision is incorrect, providing all supporting documentation.

- Legal Options: As a last resort, consult an attorney specializing in insurance claims to understand your legal rights.

For more information on navigating property claims, you can read the Residential Property Claims Guide.

Proactive Protection: Future-Proofing Your Roof

The best storm damage roof insurance claim is one you never have to file. Proactive measures can mitigate future storm damage and may lower your insurance premiums. In Northern Virginia, preparing for wind, hail, and ice is key.

A proactive strategy includes:

- Regular Maintenance: A well-maintained roof is more resilient. Routinely check that shingles are intact and flashing is sealed.

- Professional Roof Inspections: Schedule professional roof inspections annually and after severe storms to catch weaknesses early.

- Impact-Resistant Shingles: When replacing your roof, consider impact-resistant shingles (UL 2218 Class 4), which better withstand hail and may earn you an insurance discount.

- Trimming Overhanging Trees: Regularly trim branches near your roof to prevent them from falling and causing damage during storms.

- Gutter Cleaning: Keep gutters clean to ensure proper drainage and prevent water backup that can damage your roof structure.

You may be able to find information on incentives for stronger roofs, such as the FORTIFIED Roof™ designation, which can lead to insurance discounts.

Insurance Considerations for Older Roofs and Materials

Your roof’s age and material significantly impact your insurance coverage and how a storm damage roof insurance claim is handled.

- Roof Age and Coverage: Insurers consider older roofs a higher risk, which can lead to higher premiums or ACV-only coverage. A roof over 10 years old may only be covered for its depreciated value. Some insurers may even decline to renew policies on very old roofs, making timely replacement essential.

- Specific Material Considerations:

- Asphalt shingle roofs are common, but older shingles are more prone to storm damage.

- Metal roofing is highly durable and may qualify for insurance discounts.

- Cedar shake roofs have unique maintenance needs and different insurance considerations.

Always communicate with your insurance provider about your roof’s age and material to clarify your coverage.

Frequently Asked Questions about Roof Damage Claims

Here are answers to common questions homeowners in Northern Virginia have about a storm damage roof insurance claim.

What types of roof damage are typically covered by insurance?

Most homeowners insurance policies cover roof damage from sudden and accidental events, or “perils.” This typically includes damage from:

- Wind and hail

- Falling objects (trees, debris)

- Fire and lightning

- The weight of ice and snow

Damage from general wear and tear, neglect, or long-term leaks is usually not covered. For more details on hail, read our guide on what to do after storm hail damage.

How long do I have to file a roof damage claim?

The timeframe to file a storm damage roof insurance claim depends on your policy, but it is typically one to two years from the date of the storm. However, it is always best to file as soon as you find the damage. Delaying can make it harder to prove the storm was the cause and may lead to a denial. Check your policy documents to confirm your specific deadline.

Will filing a storm damage claim increase my insurance premium?

Filing a claim for an “Act of God” event like a storm should not directly cause your individual premium to increase. Insurers are more likely to raise rates for an entire region affected by a storm rather than penalize a single policyholder. However, laws vary by state. If you see a premium hike after a claim, you have the right to question it with your provider.

Your Partner in Storm Recovery

Navigating a storm damage roof insurance claim can be complex, but with the right knowledge and a trusted partner, you can achieve a successful outcome. The most important factors are understanding your policy, knowing your rights, and documenting every detail.

At Loudoun Roofing, we empower homeowners in Leesburg, Loudoun County, and across Northern Virginia. We bring our expertise to every step, from a thorough post-storm roof inspection to working with adjusters and ensuring your roof is repaired with the highest quality materials. Our commitment to durable, expertly crafted roofing and adherence to building codes ensures you get the best outcome.

For expert assistance with your storm hail damage and navigating the claims process in Northern Virginia, request a free estimate online. We’re here to help you weather any storm.